capital gains tax increase 2021 retroactive

Top earners may pay up. On the tax front the biggest surprise in Bidens proposal is that he assumes an increase in the capital gains rate would be retroactive to April 2021.

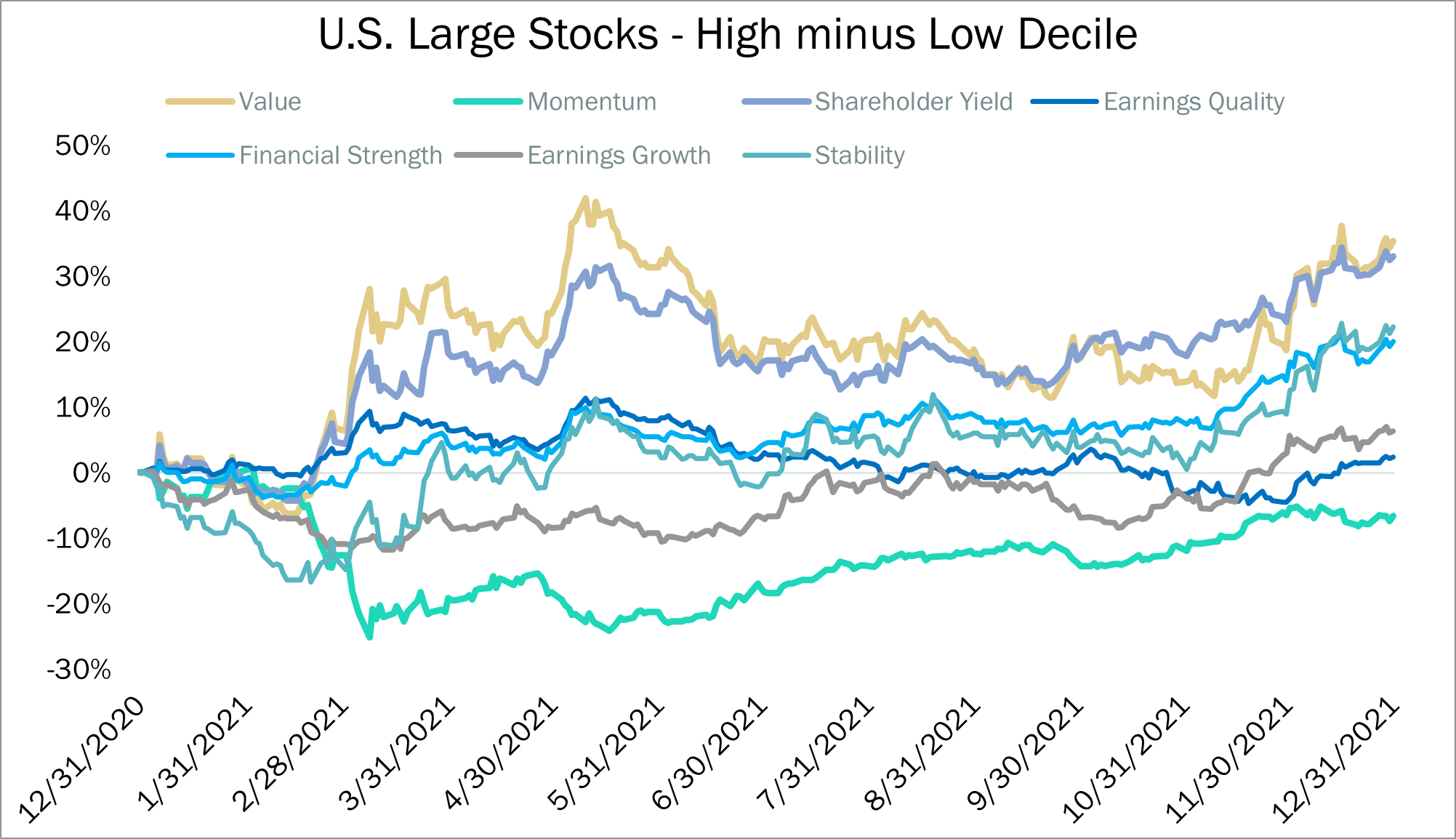

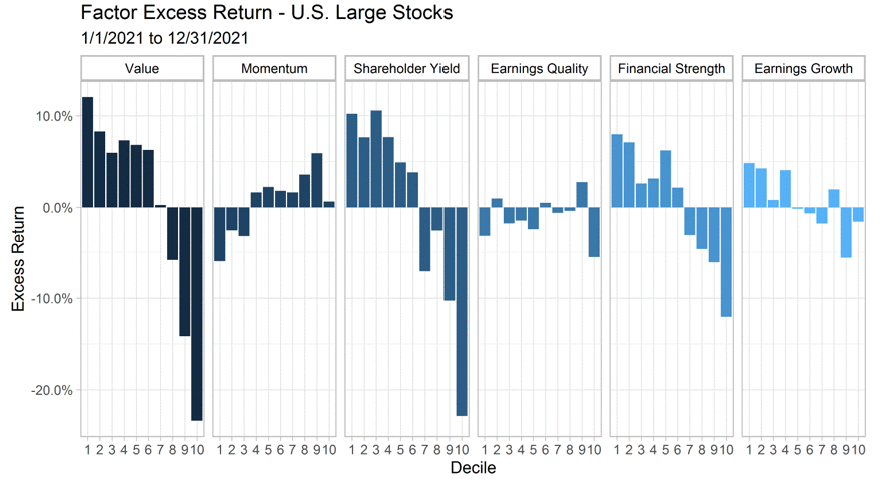

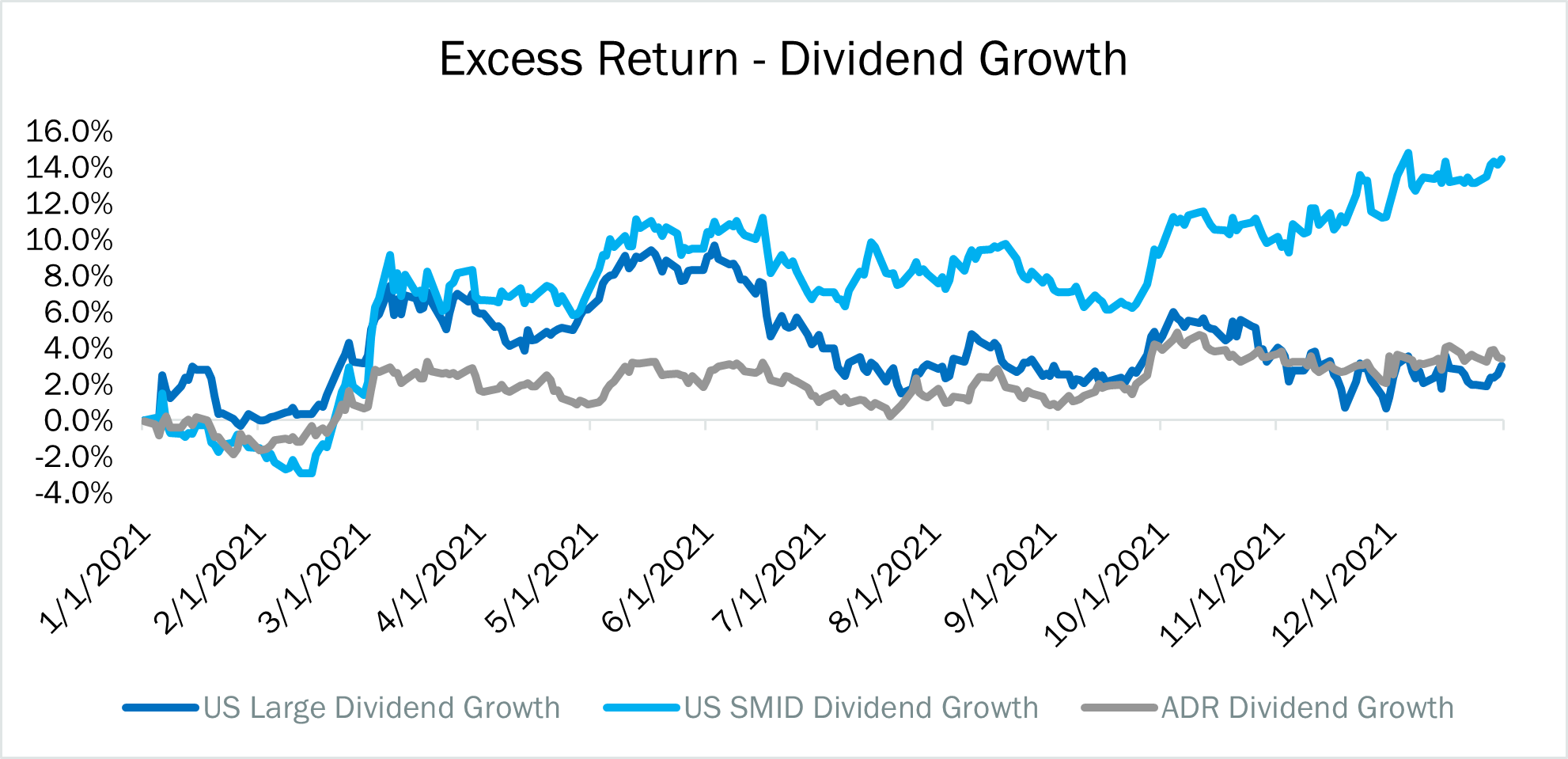

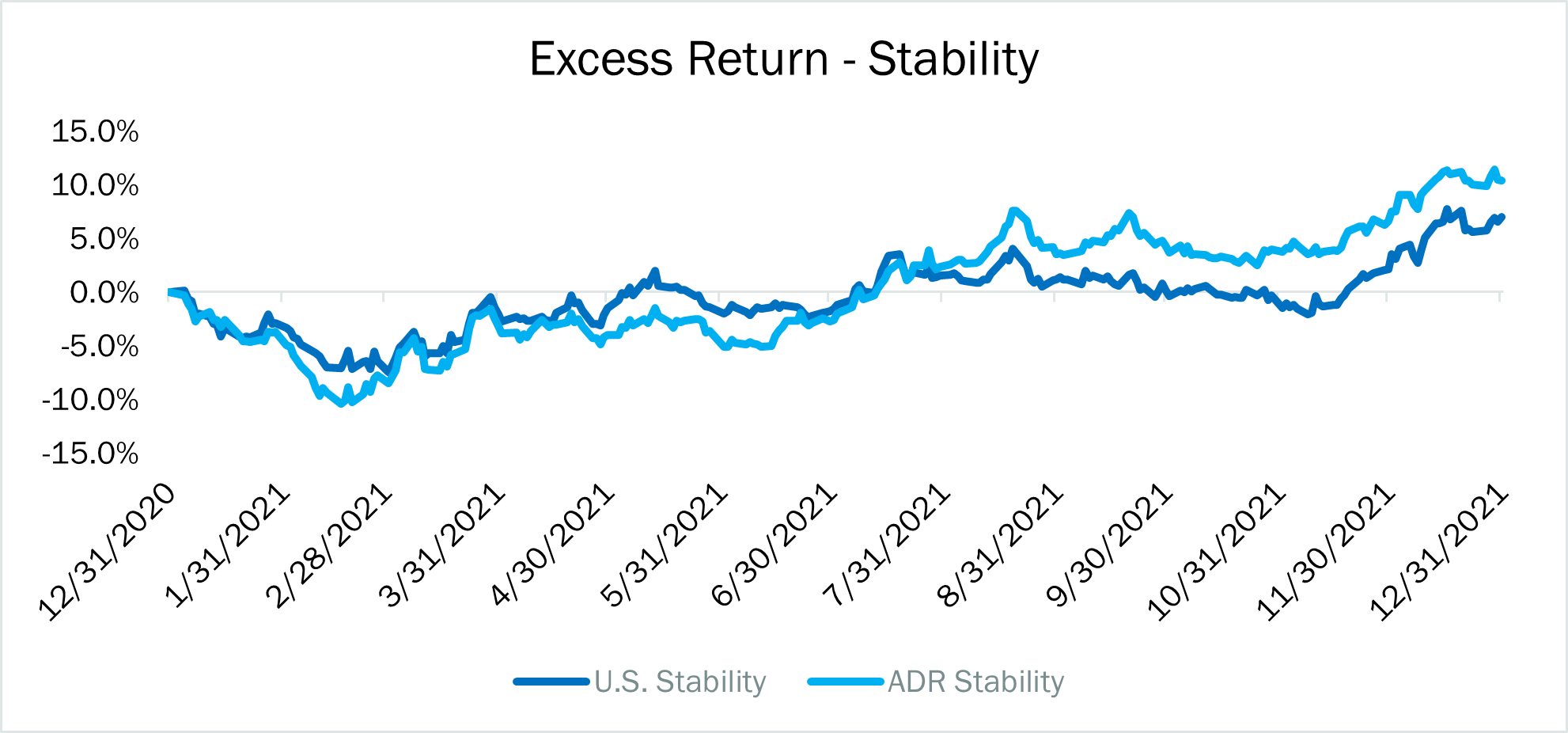

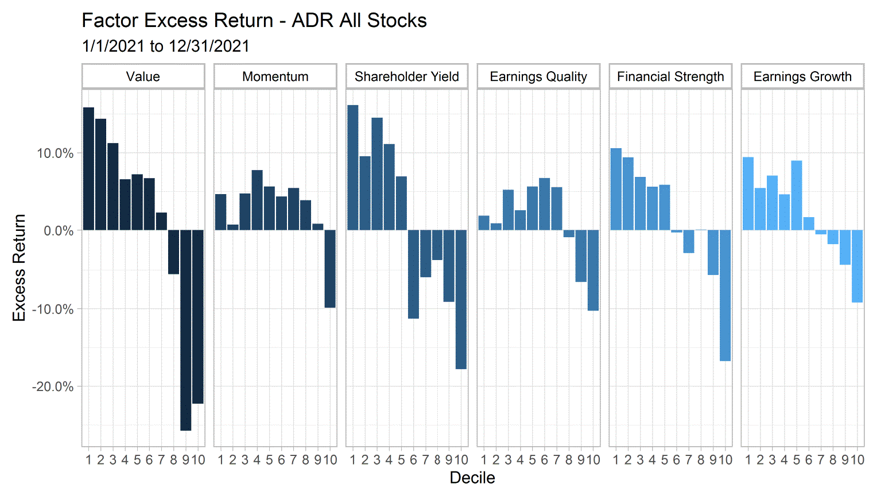

Canvas Q4 Commentary O Shaughnessy Asset Management

Bidens pre-election proposal advocated almost doubling the top tax rate on capital gains from the current 20 or 238 including the Medicare surtax to a rate equal to.

. President Joe Biden released his proposed 2022 fiscal year budget on Friday which calls for an increase of the top capital gains tax rate to 396. My guess is that since the Democratic majority is so thin there is little chance any tax increase will be made retroactive to January 1 2021. JD CPA PFS.

The later in the year that a. Top earners may pay up to. The later in the year that a.

2 Proposed Biden Retroactive Capital Gains Tax National axpayers Union ondation Could Be Challenged on Constitutional Grounds levying a 10 percent surtax on high earners6 imposing a. It appears that the White House is planning to make the effective date for its proposed tax increase on long-term capital gains retroactive to April 2021. As expected the Presidents proposal would increase the top marginal ordinary income tax rate from 37 to 396 and would apply ordinary income tax rates to capital gains.

One idea in play is a. The top rate for 2021 is 37 plus the Medicare surtax of 38 plus state. My guess is that.

Treasury Secretary Janet Yellen suggested in remarks before a Senate panel that if Congress were to pass a capital-gains tax hike effective. Biden unveiled a budget proposal Friday June 4 2021 that called for a 396 top capital gains tax rate to help pay for the American Families Plan. So its no surprise that President Biden is calling for.

Biden unveiled a budget proposal Friday June 4 2021 that called for a 396 top capital gains tax rate to help pay for the American Families Plan. My guess is that since the Democratic majority is so thin there is little chance any tax increase will be made retroactive to January 1 2021. The most dramatic tax changes usually occur after a 180-administration change like the one we just experienced.

For taxpayers with income of over 1 million long-term capital gains will be taxed at ordinary rates. It appears that the White House is planning to make the effective date for its proposed tax increase on long-term capital gains retroactive to April 2021.

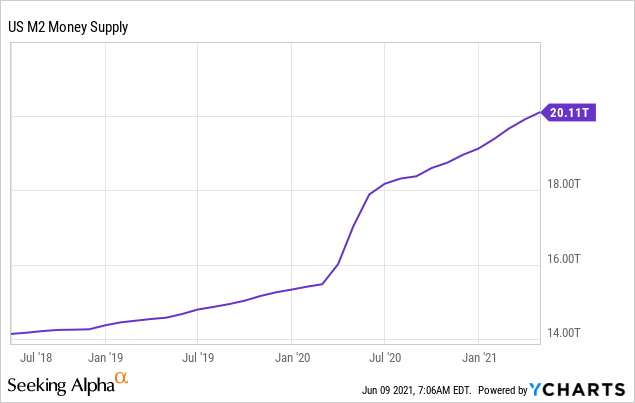

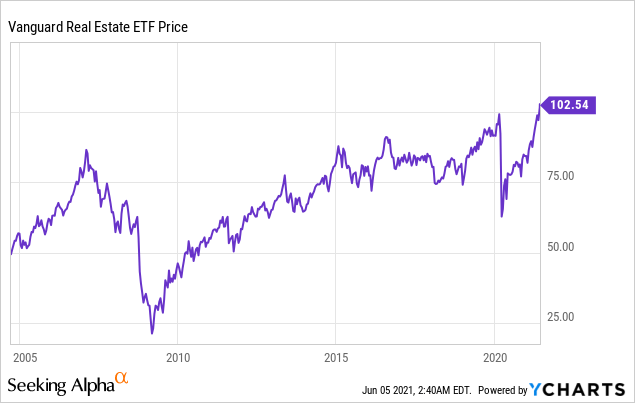

Very Bad News For Reit Investors Seeking Alpha

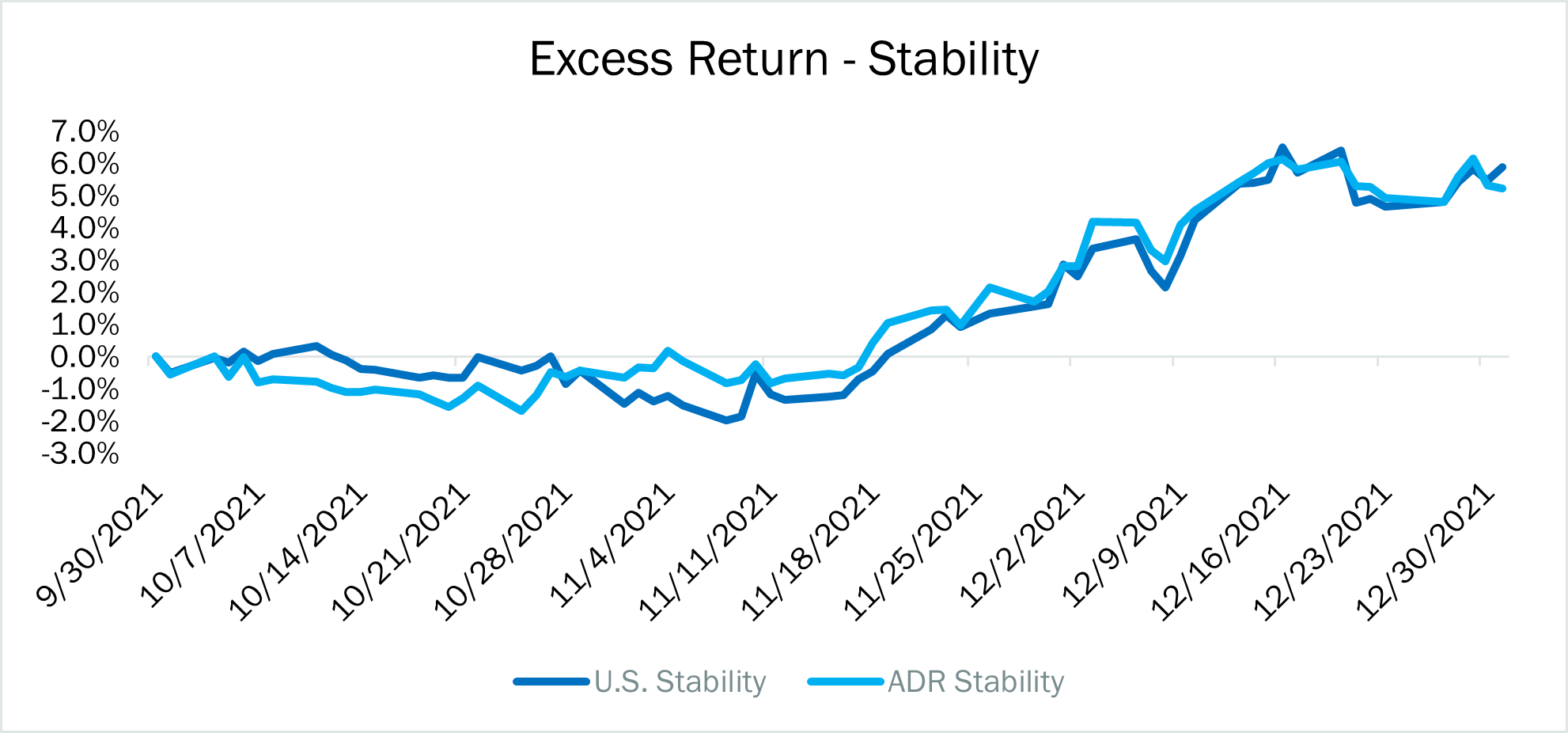

Canvas Q4 Commentary O Shaughnessy Asset Management

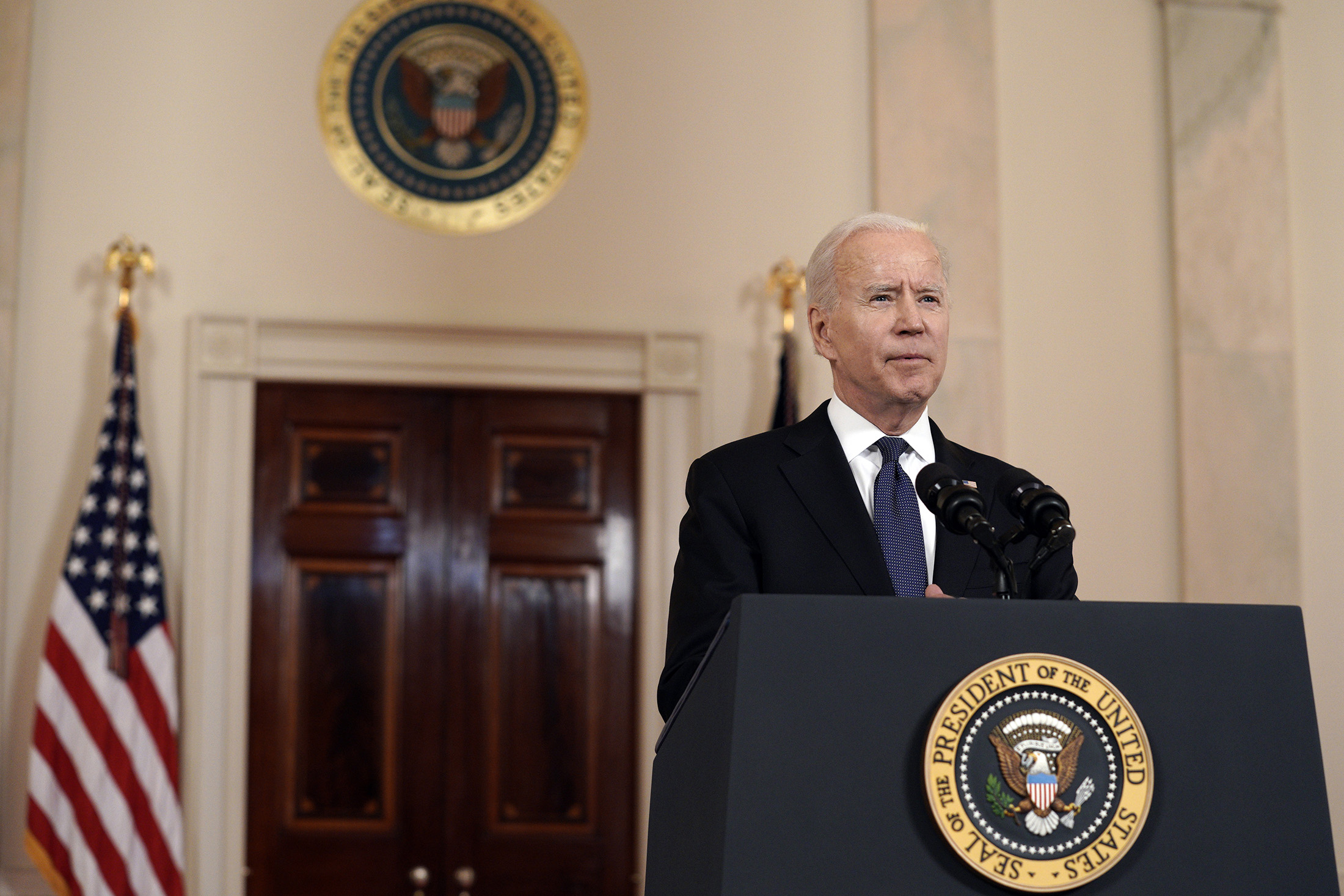

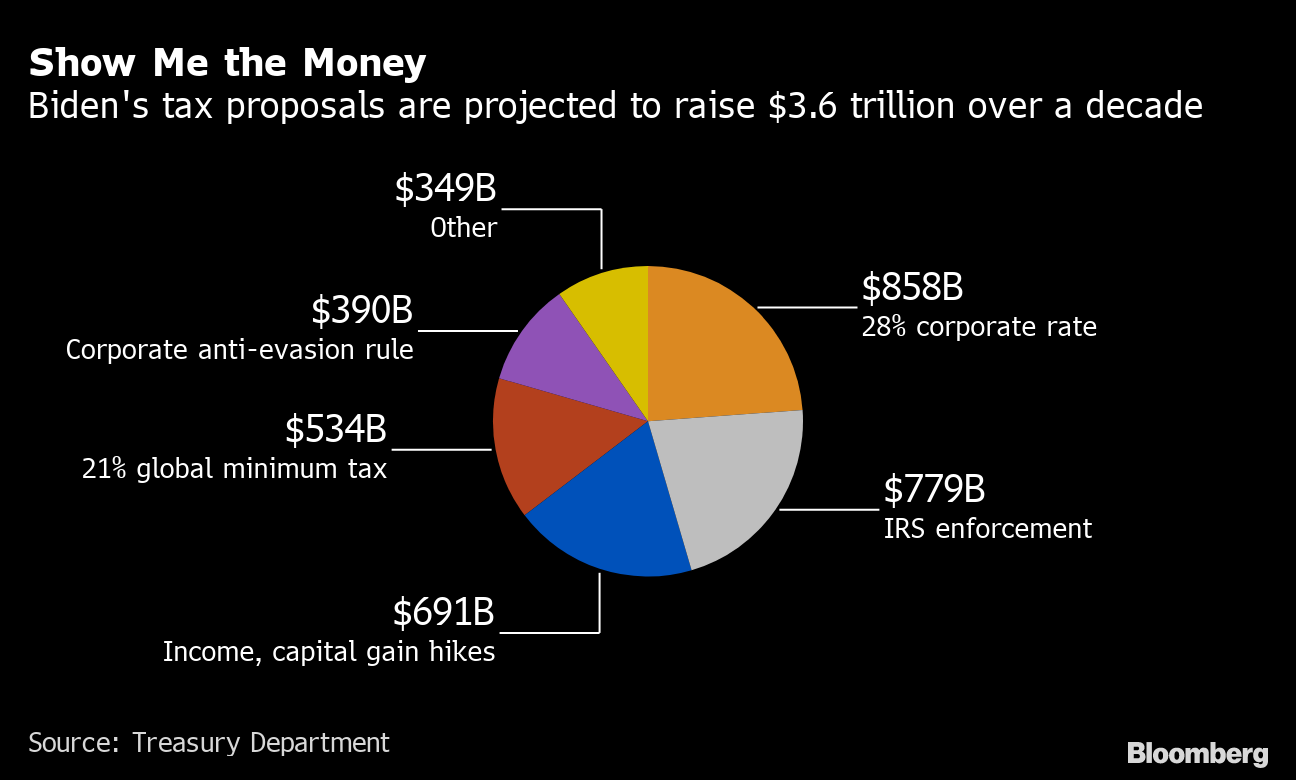

Biden Tax Hike Treasury Forecasts Plan To Bring In 3 6 Trillion Over Decade Bloomberg

Biden Tax Hike Treasury Forecasts Plan To Bring In 3 6 Trillion Over Decade Bloomberg

The New Death Tax In The Biden Tax Proposal Major Tax Change

The New England Patriots Officially Signed Restricted Free Agent Wide Receiver Jakobi Meyers On Thursday Mey In 2022 Canadian Football League Patriots Sign Free Agent

Rethinking Inheritance Cairn International Edition

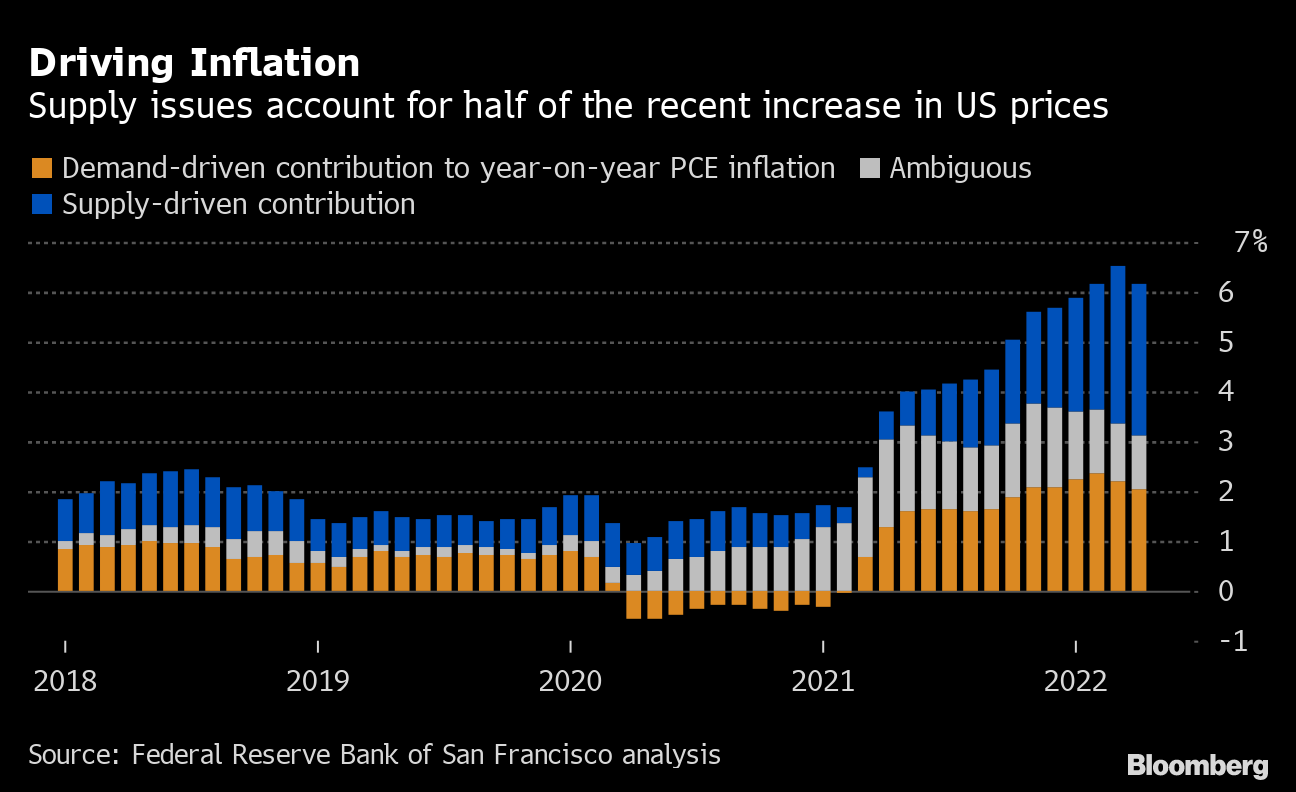

China Tariffs Biden To Get Little Inflation Relief If He Eases Trump Era Policy Bloomberg

President Biden S Budget Adopts One Of California S Most Controversial Ideas

Canvas Q4 Commentary O Shaughnessy Asset Management

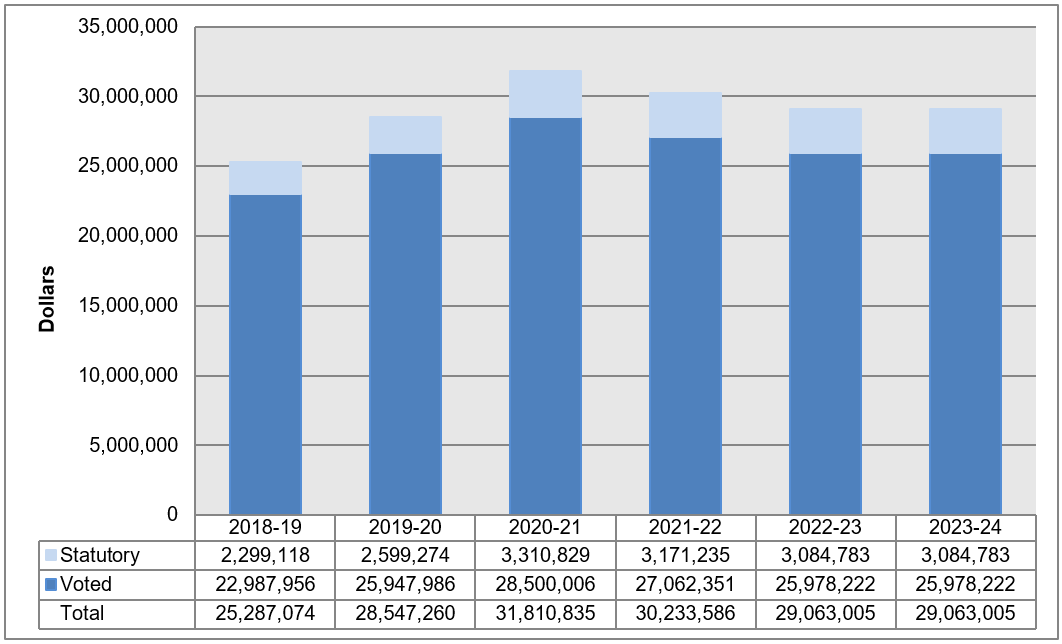

2020 21 Departmental Results Report Office Of The Privacy Commissioner Of Canada

Canvas Q4 Commentary O Shaughnessy Asset Management

Canvas Q4 Commentary O Shaughnessy Asset Management

Very Bad News For Reit Investors Seeking Alpha